The Financial Gameplan

Master Your Finances with the Precision of a Pro Athlete

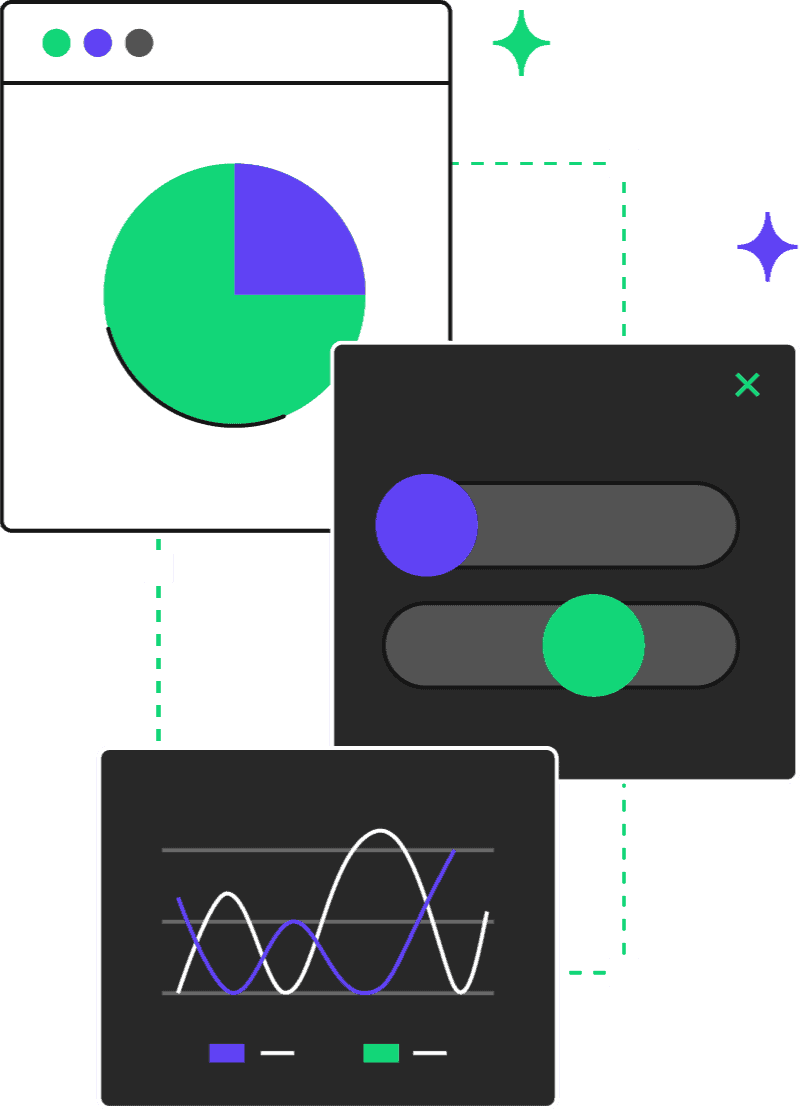

In the world of sports, every game begins with a solid game plan. It’s the strategy that positions teams for victory, anticipating challenges and capitalizing on opportunities. “The Financial Gameplan” takes this winning principle onto the financial field, guiding athletes like you through the foundational skills of effective money management.

Who Should Participate?

Athletes looking to take control of their NIL earnings

Sports professionals seeking financial stability and growth

Anyone in the sports ecosystem aiming to build a strong financial foundation

The Financial Playbook

What You Will Learn

Budgeting is more than just tracking expenses; it’s about creating a roadmap for financial freedom and success. Whether you’re a rookie in the world of finance or looking to refine your skills, this module equips you with the knowledge to navigate your NIL income confidently.

Craft Your Financial Game Plan:

Just as a coach outlines plays for a big matchup, we’ll teach you how to create a budget plan that aligns with your financial goals, ensuring you’re set for success in any financial season.

Play Offense and Defense with Your Expenses:

Learn to differentiate between fixed and variable expenses. We’ll show you how to manage these costs strategically, ensuring you keep your financial defense strong while making offensive moves towards your goals.

Set and Score Your Financial Goals:

Every athlete dreams of scoring that game-winning goal. We’ll help you set achievable financial targets and outline the steps to reach them, turning dreams into reality.

By the end of “The Financial Gameplan,” you’ll have a personalized budget that reflects your financial aspirations, a clear understanding of how to manage your expenses, and the confidence to set and achieve your financial goals. Equip yourself with the budgeting skills of a veteran, and turn your financial game into a championship-winning strategy.

What you’ll find in our FREE Online Course

Module 1: The Financial Gameplan - Budgeting Basics

Creating a budget plan, understanding fixed vs. variable expenses, and setting financial goals.

Module 2: Building a Strong Defense - Understanding Credit

How credit scores work, ways to build good credit, and how to use credit cards wisely.

Module 3: Winning the Tax Game

Overview of tax responsibilities for NIL income, deductions, and credits applicable to athletes.

Module 4: Scouting the Field - Navigating Cost of Living

How to manage living expenses, understanding cost of living in different cities, and financial planning for essential needs.

Module 5: The Car Buying Draft

Assessing needs vs. wants, new vs. used, negotiating prices, and understanding loans and leases.

Module 6: Home Field Advantage - Buying Your First Home

Steps in the home buying process, mortgages, and how to save for a down payment.

Module 7: The Debt Repayment Play

Strategies for tackling different types of debt, debt repayment plans, and the snowball vs. avalanche methods.

Module 8: Investing in Your Future Self

Basics of investing, retirement accounts, and how to diversify investments like a well-rounded athlete.

Ready to Chat 1:1 With a Coach?

1:1 Coaching

Guidance on Major Financial Decisions (Home & Car Purchases)

Workshops

In-Person Workshops for Real-World Application

Game Plans

Personal Financial Game Plans for Budgeting, & Investing

Tax Planning

Tax Strategies & Compliance Assistance